World Class Renewable energy sales and Crude Oil Sourcing on a global Scale

We are committed to delivering world class services to all our clients, to continuing to confront global energy sector challenges and to becoming one of the recognized global leaders in the oil and gas industry.

World Class Renewable energy sales and Crude Oil Sourcing on a global Scale

We are committed to delivering world class services to all our clients, to continuing to confront global energy sector challenges and to becoming one of the recognized global leaders in the oil and gas industry.

World Class Renewable energy sales and Crude Oil Sourcing on a global Scale

We are committed to delivering world class services to all our clients, to continuing to confront global energy sector challenges and to becoming one of the recognized global leaders in the oil and gas industry.

World Class Renewable energy sales and Crude Oil Sourcing on a global Scale

We are committed to delivering world class services to all our clients, to continuing to confront global energy sector challenges and to becoming one of the recognized global leaders in the oil and gas industry.

World Class Renewable energy sales and Crude Oil Sourcing on a global Scale

We are committed to delivering world class services to all our clients, to continuing to confront global energy sector challenges and to becoming one of the recognized global leaders in the oil and gas industry.

World Class Renewable energy sales and Crude Oil Sourcing on a global Scale

We are committed to delivering world class services to all our clients, to continuing to confront global energy sector challenges and to becoming one of the recognized global leaders in the oil and gas industry.

World Class Renewable energy sales and Crude Oil Sourcing on a global Scale

We are committed to delivering world class services to all our clients, to continuing to confront global energy sector challenges and to becoming one of the recognized global leaders in the oil and gas industry.

World Class Renewable energy sales and Crude Oil Sourcing on a global Scale

We are committed to delivering world class services to all our clients, to continuing to confront global energy sector challenges and to becoming one of the recognized global leaders in the oil and gas industry.

World Class Renewable energy sales and Crude Oil Sourcing on a global Scale

We are committed to delivering world class services to all our clients, to continuing to confront global energy sector challenges and to becoming one of the recognized global leaders in the oil and gas industry.

World Class Renewable energy sales and Crude Oil Sourcing on a global Scale

We are committed to delivering world class services to all our clients, to continuing to confront global energy sector challenges and to becoming one of the recognized global leaders in the oil and gas industry.

World Class Renewable energy sales and Crude Oil Sourcing on a global Scale

We are committed to delivering world class services to all our clients, to continuing to confront global energy sector challenges and to becoming one of the recognized global leaders in the oil and gas industry.

World Class Renewable energy sales and Crude Oil Sourcing on a global Scale

We are committed to delivering world class services to all our clients, to continuing to confront global energy sector challenges and to becoming one of the recognized global leaders in the oil and gas industry.

World Class Renewable energy sales and Crude Oil Sourcing on a global Scale

We are committed to delivering world class services to all our clients, to continuing to confront global energy sector challenges and to becoming one of the recognized global leaders in the oil and gas industry.

World Class Renewable energy sales and Crude Oil Sourcing on a global Scale

We are committed to delivering world class services to all our clients, to continuing to confront global energy sector challenges and to becoming one of the recognized global leaders in the oil and gas industry.

World Class Renewable energy sales and Crude Oil Sourcing on a global Scale

We are committed to delivering world class services to all our clients, to continuing to confront global energy sector challenges and to becoming one of the recognized global leaders in the oil and gas industry.

World Class Renewable energy sales and Crude Oil Sourcing on a global Scale

We are committed to delivering world class services to all our clients, to continuing to confront global energy sector challenges and to becoming one of the recognized global leaders in the oil and gas industry.

World Class Renewable energy sales and Crude Oil Sourcing on a global Scale

We are committed to delivering world class services to all our clients, to continuing to confront global energy sector challenges and to becoming one of the recognized global leaders in the oil and gas industry.

World Class Renewable energy sales and Crude Oil Sourcing on a global Scale

We are committed to delivering world class services to all our clients, to continuing to confront global energy sector challenges and to becoming one of the recognized global leaders in the oil and gas industry.

World Class Renewable energy sales and Crude Oil Sourcing on a global Scale

We are committed to delivering world class services to all our clients, to continuing to confront global energy sector challenges and to becoming one of the recognized global leaders in the oil and gas industry.

World Class Renewable energy sales and Crude Oil Sourcing on a global Scale

We are committed to delivering world class services to all our clients, to continuing to confront global energy sector challenges and to becoming one of the recognized global leaders in the oil and gas industry.

World Class Renewable energy sales and Crude Oil Sourcing on a global Scale

We are committed to delivering world class services to all our clients, to continuing to confront global energy sector challenges and to becoming one of the recognized global leaders in the oil and gas industry.

World Class Renewable energy sales and Crude Oil Sourcing on a global Scale

We are committed to delivering world class services to all our clients, to continuing to confront global energy sector challenges and to becoming one of the recognized global leaders in the oil and gas industry.

World Class Renewable energy sales and Crude Oil Sourcing on a global Scale

We are committed to delivering world class services to all our clients, to continuing to confront global energy sector challenges and to becoming one of the recognized global leaders in the oil and gas industry.

World Class Renewable energy sales and Crude Oil Sourcing on a global Scale

We are committed to delivering world class services to all our clients, to continuing to confront global energy sector challenges and to becoming one of the recognized global leaders in the oil and gas industry.

World Class Renewable energy sales and Crude Oil Sourcing on a global Scale

We are committed to delivering world class services to all our clients, to continuing to confront global energy sector challenges and to becoming one of the recognized global leaders in the oil and gas industry.

World Class Renewable energy sales and Crude Oil Sourcing on a global Scale

We are committed to delivering world class services to all our clients, to continuing to confront global energy sector challenges and to becoming one of the recognized global leaders in the oil and gas industry.

World Class Renewable energy sales and Crude Oil Sourcing on a global Scale

We are committed to delivering world class services to all our clients, to continuing to confront global energy sector challenges and to becoming one of the recognized global leaders in the oil and gas industry.

World Class Renewable energy sales and Crude Oil Sourcing on a global Scale

We are committed to delivering world class services to all our clients, to continuing to confront global energy sector challenges and to becoming one of the recognized global leaders in the oil and gas industry.

World Class Renewable energy sales and Crude Oil Sourcing on a global Scale

We are committed to delivering world class services to all our clients, to continuing to confront global energy sector challenges and to becoming one of the recognized global leaders in the oil and gas industry.

World Class Renewable energy sales and Crude Oil Sourcing on a global Scale

We are committed to delivering world class services to all our clients, to continuing to confront global energy sector challenges and to becoming one of the recognized global leaders in the oil and gas industry.

World Class Renewable energy sales and Crude Oil Sourcing on a global Scale

We are committed to delivering world class services to all our clients, to continuing to confront global energy sector challenges and to becoming one of the recognized global leaders in the oil and gas industry.

World Class Renewable energy sales and Crude Oil Sourcing on a global Scale

We are committed to delivering world class services to all our clients, to continuing to confront global energy sector challenges and to becoming one of the recognized global leaders in the oil and gas industry.

World Class Renewable energy sales and Crude Oil Sourcing on a global Scale

We are committed to delivering world class services to all our clients, to continuing to confront global energy sector challenges and to becoming one of the recognized global leaders in the oil and gas industry.

"Confronting Global Energy Challenges"

"AHPE OFFERS SPOT BUY AND CIF CONTRACTS ONLY, BEWARE"

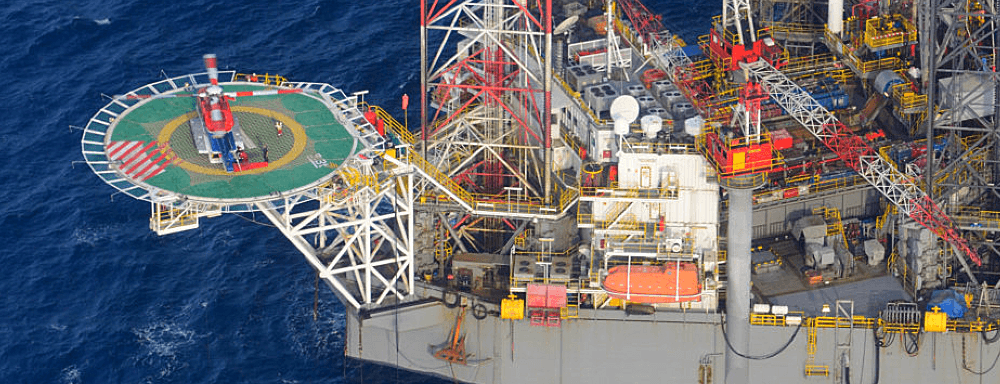

Niger-Delta Operation

Energy is vital to our daily lives. It helps us produce food, fuel transport and power communication channels across the world.

Read more